Bitcoin price now

As Bitcoin continues to fluctuate in price, it's important to stay informed on the latest developments in the cryptocurrency market. Whether you're a seasoned investor or new to the world of digital currencies, these four articles will provide valuable insights into the current Bitcoin price trends and factors influencing its value.

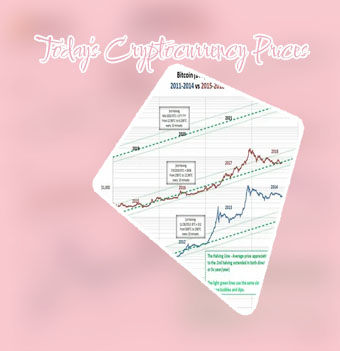

Analyzing the Factors Influencing Bitcoin Price Fluctuations

Bitcoin's price fluctuations have become a topic of great interest for investors and analysts around the world. This article delves into the various factors that influence the price of Bitcoin, shedding light on the complexities of this volatile market.

One key factor that impacts Bitcoin's price is market demand. Just like any other asset, the price of Bitcoin is largely determined by the laws of supply and demand. When demand for Bitcoin increases, its price tends to rise, and vice versa. This can be driven by a variety of factors including geopolitical events, economic indicators, and even social media trends.

Another important factor to consider is regulatory developments. The legal status of Bitcoin varies from country to country, and changes in regulations can have a significant impact on its price. For example, news of a government crackdown on cryptocurrency exchanges can lead to a sharp drop in Bitcoin's price, while positive regulatory developments can boost investor confidence and drive up prices.

Additionally, technological advancements and market sentiment play a role in Bitcoin's price fluctuations. The introduction of new technologies, such as the Lightning Network, can improve the scalability and usability of Bitcoin, potentially leading to an increase in demand. Similarly, shifts in market sentiment can cause prices to swing in either direction, as investors react to news and events in real-time.

Expert Predictions: Where Will Bitcoin Price Go Next?

I recently read an intriguing article discussing the future of Bitcoin prices and where they might be headed next. The article featured insights from experts in the field, providing valuable information for investors and enthusiasts alike.

One particular expert highlighted the potential for Bitcoin to reach new record highs in the coming months, citing factors such as increased institutional adoption and growing mainstream acceptance as key drivers of this upward trend. Another expert offered a more cautious outlook, emphasizing the volatility of the cryptocurrency market and the need for careful analysis before making investment decisions.

Overall, the article painted a comprehensive picture of the current state of Bitcoin prices and offered valuable perspectives on what the future might hold. As someone interested in the world of cryptocurrency, I found this article to be both informative and thought-provoking.

In conclusion, this article is important for those interested in understanding the factors influencing Bitcoin prices and making informed decisions about their investments in the cryptocurrency market. By presenting expert predictions and analysis, the article provides valuable insights that can help readers navigate the complex and ever-changing world of Bitcoin trading.

Understanding the Impact of Market Sentiment on Bitcoin Price

One of the key <a href"https://changelly.com/">https://changelly.com/ factors influencing these price movements is market sentiment.

Strategies for Managing Risk in a Volatile Bitcoin Market

In the fast-paced world of cryptocurrency trading, navigating the volatile Bitcoin market can be a daunting task for even the most experienced investors. With prices fluctuating wildly from day to day, it's essential to have a solid risk management strategy in place to protect your investments and maximize your returns.

One key strategy for managing risk in the Bitcoin market is diversification. By spreading your investments across a range of different assets, you can reduce the impact of any single asset's price movements on your overall portfolio. This can help to minimize your exposure to risk and ensure that you don't lose all your capital if the price of Bitcoin suddenly plummets.

Another important risk management technique is setting stop-loss orders. These orders automatically sell your Bitcoin holdings if the price drops below a certain level, helping to limit your losses in the event of a sudden market crash. By using stop-loss orders effectively, you can protect your capital and ensure that you don't suffer catastrophic losses in the volatile Bitcoin market.

For anyone looking to invest in Bitcoin or other cryptocurrencies, understanding and implementing effective risk management strategies is crucial. By diversifying your portfolio, setting stop-loss orders, and staying informed about market trends, you can navigate the volatile Bitcoin market with confidence and protect your investments from sudden price swings. Whether you're